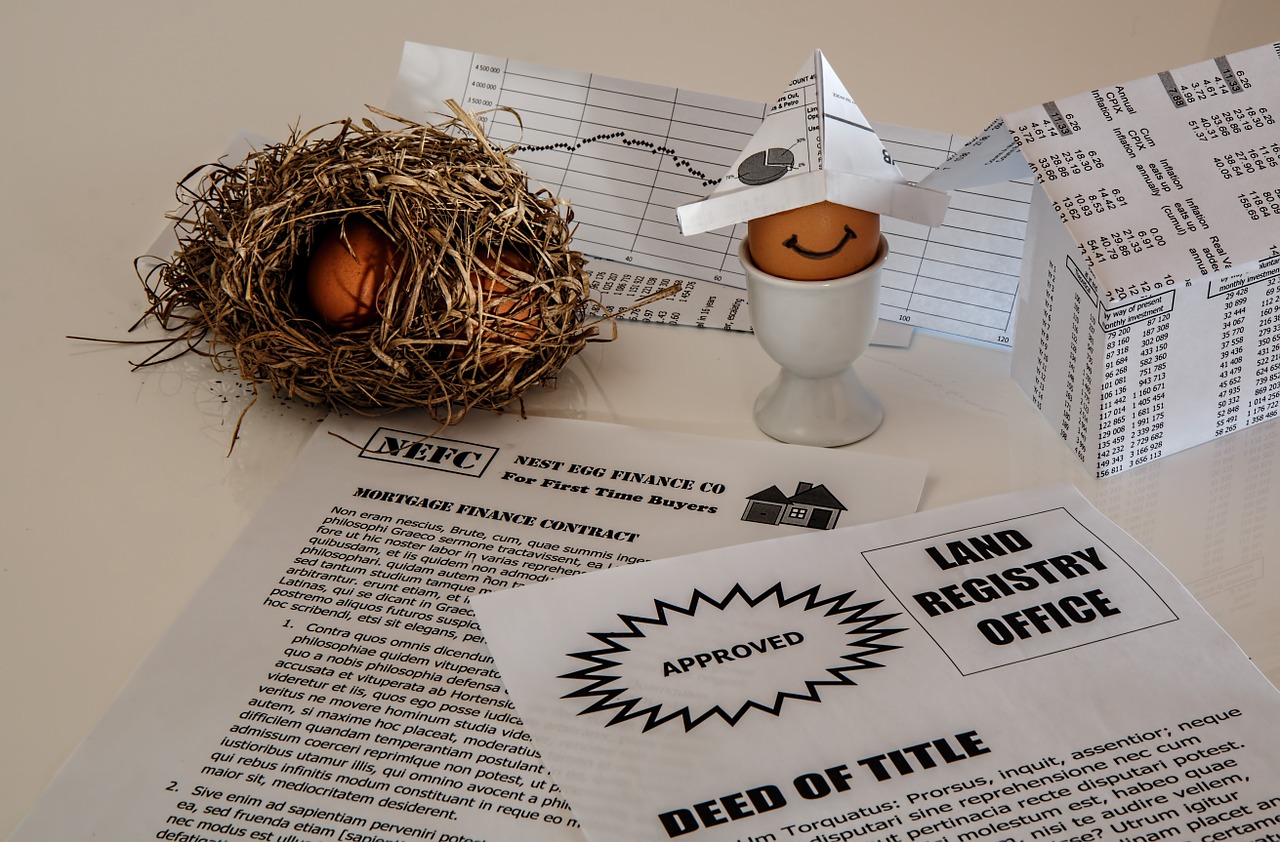

In layman’s terms, pre-approval is a document issued by the mortgage lender entailing how much money they are willing to lend. Getting your mortgage pre-approved is a vital process in home buying.

Why the Need to Get Your Mortgage Pre-Approved?

Before you scout for houses you would buy, knowing how much you can afford is crucial. This is the basic use of a mortgage pre-approval as the mortgage lender will factor in all of your financial information to make calculations. They will check stuff like income, debts, assets, liabilities, credit, etc. The validity of a pre-approved mortgage document is at most 90 days.

When you get your mortgage pre-approved, it just means that both parties are committed. Your mortgage lender can then help you devise strategies and methods as well as negotiate about the interest rates.

Where to Use It?

Most home buyers secure a pre-approved mortgage before they look for a house. It becomes your negotiating tool with the sellers when you make a purchase offer because it just means that you have the financial integrity. In fact, you can also use it as a leverage against other buyers that don’t have pre-approval document. Sellers tend to negotiate those who will take them seriously.

Moreover, it becomes a proof that you’re serious with your business which would make the real estate agent provide better services.

How to Get Pre-Approved?

By no means it’s necessary for you to secure pre-approval. Some sellers don’t require it when you’re making an offer. But as discussed just earlier, you have nothing to lose but a lot to gain.

However, it must be noted that since its validity is for just a few months, it’s not a guarantee that the mortgage lender will extend you the loan especially when your situation changes. These changes may include further incurred debt, getting laid off, etc.

The process of securing a mortgage pre-approval is through filling up a mortgage application, submitting certain documents, and giving authorization letters to your mortgage lender. These will allow them to pull up your information like credit report.

After they received your documents and checked your financial information, they are required by law to issue a document about the loan estimate within 3 days. Within the document likewise includes whether your pre-approval is granted, mortgage terms, estimated monthly amortization, estimated closing costs and insurances, etc.

Conclusion

When you file for a pre-approval, it’s important that you know a lot about yourself. Start now with listing your financial information like assets, debts, liabilities, etc. If your credit score is not considerably high, you have time to prepare in improving it.