You thought closing the mortgage and moving into your new house is the end of all the preparations you need after buying a home sweet home? Well, not exactly. As responsible homeowners, you should also ready yourselves for the physical and financial strains after moving in just as much as you did for preparing to […]

In purchasing a home, budgeting is more important than ever. We know it’s easier said than done because a house is likely to be the most expensive buy you’ll ever make. It’s exciting and you might even dream of wanting a huge bedroom, a wide landscape with a gazebo, and even a walk-in closet. However, […]

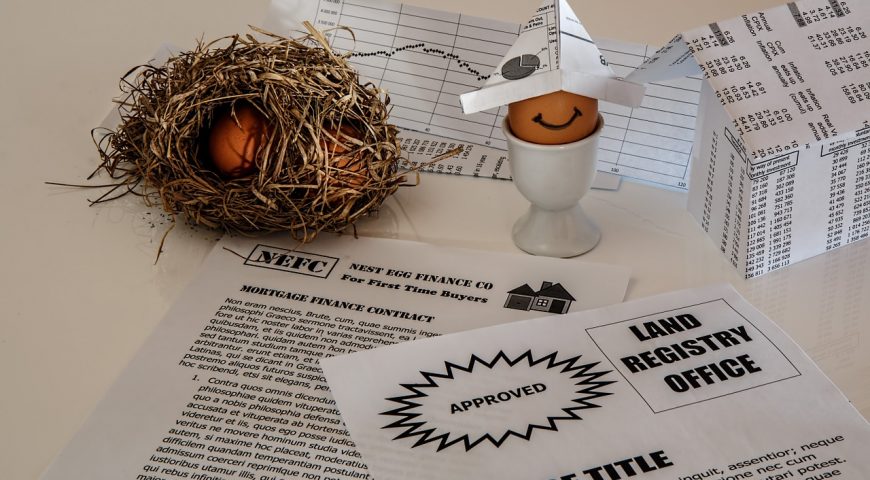

In layman’s terms, pre-approval is a document issued by the mortgage lender entailing how much money they are willing to lend. Getting your mortgage pre-approved is a vital process in home buying. Why the Need to Get Your Mortgage Pre-Approved? Before you scout for houses you would buy, knowing how much you can afford is […]

There’s a common notion that the houses on sale during winter are scraps from previous seasons due to being overpriced or some other reasons. But this might be your perfect chance in saving most of your thousands as the winter season (December to February) offers the lowest prices than any other time of the year. […]

Now that you have saved enough for your down payment and/or secured a mortgage pre-approval, the next thing that you do is to browse real estate market to look for low prices. As discussed in the previous article, the autumn and winter seasons are the best times where prices are at their lowest. But what […]

The real estate is an industry that has no chances of crashing in the near future. People almost always sell or buy property which in turn give myriad choices as per the definition of a perfect competition market. Many aspiring homeowners ask this same question repeatedly: “When’s the best time to buy a house or […]

When reading about getting mortgage loans, surely you have encountered the mortgage brokers in one of your searches. How do they differ from mortgage lenders in banks and mortgage companies? This article will answer your questions as well as advising you whether you should get one. What are Mortgage Brokers? A mortgage broker is simply […]

When you only have enough money for the house down payment, the best course to consider is getting a mortgage loan. Loans are usually taken out from banks. But when the interest rates offered are not favorable, people turn to direct lenders. How does one choose a mortgage lender? In this article, we’ll guide in […]

After a long time of pondering, you now have decided that you will no longer rent. You liked the city you’re in and you now wish to own a house somewhere. Is transitioning from a renter to homeowner really hard? Through this article, you will know if you’re ready and the steps to take to […]

When buying a real estate property, most people don’t directly pay in cash and instead secure a mortgage loan from the bank or other creditors. But when the unthinkable happened like when you lost your job, you need to cut back on certain expenses. What happens when you can no longer afford the monthly amortization? […]